On the SP500

On Friday there was a surge of sales but did not cause serious damage.

As we can see in the graph above, the S & P 500 did not drill the first bullish straight line on Friday. However, the volume traded down during the session was high.

In our comment on Friday we said: " The base of the channel will pass today by the vicinity of 1,330. While it remains above we will consider that the dominant trend in the short term is bullish. "

.

ANALISISBOLSA LUIS ORTIZ ZARATE 13-02-2012

This downward movement, according to my criteria, is of greater relevance to those that have occurred since January 6, and at least we could expect a downward movement similar to that of the first of January. This bearish outlook would initially be conditioned to not restart the upward movement

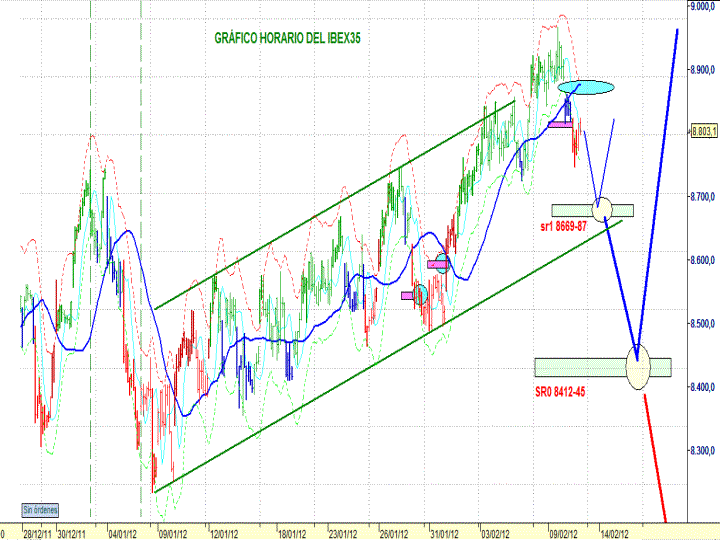

From the perspective of bearish continuity, which is what I think is most likely, the movement should be clear until the Relevant Support sr1 8670. The idea is that if the sr1 is broken down, an alternative of bearish continuity would open up almost the 8,400 points, zone where the SR0 is, this zone is what should serve to resume the upward movement to direct the IBEX to 9,350 points.

Greetings and thank you.

Experts Training

No olviden que tanto para este como para los demás tipos de análisis a la hora de operar en los mercados financieros se debe de hacer de manera responsable teniendo en cuenta aspectos como la gestión monetaria y la gestión del riesgo para poder gestionar de una manera adecuada y eficiente su cartera de valores, considerando además otros aspectos como el broker con el que se invierte, psicología entre otros muchos factores.

Un saludo, formese en análisis bursátil para conocer que acciones comprar en bolsa y buen trading.

Lectura recomendada

Actores empíricos

Abandono de acción

No hay comentarios:

Publicar un comentario